Grenada Corporation

Use the note on Disclosure of Leases for the Grenada Corporation to answer the questions that follow.

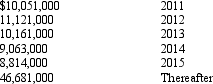

The Corporation leases office,warehouse and showroom space,retail stores and office equipment under operating leases,which expire no later than 2025.The Corporation normalizes fixed escalations in rental expense under its operating leases.Minimum annual rentals under non-cancelable operating leases,excluding operating cost escalations and contingent rental amounts based upon retail sales,are payable as follows:

Fiscal year ending March 31,

Rent expense was $12,551,000;$8,911,000;and $5,768,000 for the years ended March 31,2010,2009,and 2008 respectively.

Rent expense was $12,551,000;$8,911,000;and $5,768,000 for the years ended March 31,2010,2009,and 2008 respectively.

Review the information for Grenada Corporation.

REQUIRED:

(1)What are the two types of leases that a company can have? Describe each briefly.

(2)Does the note disclosure show evidence of the two types of leases?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q145: The effective interest method amortizes premium or

Q146: If the market rate of interest is

Q150: Discount on Bonds Payable is shown on

Q154: Under the effective interest method of amortization,the

Q157: A(n)_ lease is recorded on the lessee's

Q162: In calculating deferred income taxes,_ occur when

Q163: One of your friends is majoring in

Q164: For a capital lease,the lessee must record

Q180: Although operating leases are not recorded on

Q185: A friend of yours has asked you

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents