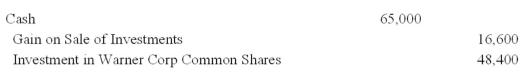

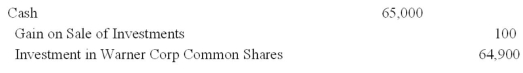

On January 4,Year 1,Larsen Corp purchased 10,000 shares of Warner Corp for $119,000 plus a broker's fee of $2,000.Warner Corp has 50,000 common shares outstanding and it is presumed the Larsen Corp will have a significant influence over Warner Corp.During Year 1 and Year 2,Warner Corp declared and paid cash dividends of $0.85 per share.Warner Corp's net income was $72,000 and $67,000 for Year 1 and year 2,respectively.The January 12,Year 3 entry to record the sale of 5,000 shares of Warner Corp for $65,000 should be:

A)

B)

C)

D)

E)

Correct Answer:

Verified

Q94: Micron owns 16% of JVT as an

Q95: Micron owns 40% of the outstanding Martok

Q96: Investments in associates are:

A) Recorded at historical

Q98: World Co.paid $25,000 to buy 10% Core

Q98: Accounting for long-term investments in equity securities

Q100: On December 31,as a short-term investment,Arlington and

Q101: On January 1,2015,Parris Corporation purchased 75% of

Q103: As a significant influence investment,Music City held

Q104: Joint arrangements should be accounted for using:

A)

Q107: Explain how significant influence or investments in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents