Marko,Billy,and Jellian are liquidating their partnership.They have no agreement for sharing profits and losses.The ending capital account balances are Marko,$13,000; Billy,$13,000; Jellian,($2,000) .There is $24,000 in cash to be distributed to the partners.The journal entry to record the distribution should be:

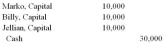

A)

B)

C)

D)

E)

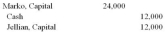

Correct Answer:

Verified

Q24: A capital deficiency exists when all partners

Q30: A capital deficiency can arise from liquidation

Q38: Chen and Wright are forming a partnership.Chen

Q40: Partnership accounting:

A) Is the same as accounting

Q40: The fact that partnership assets are owned

Q43: A partner can withdraw from a partnership

Q44: The withdrawals account of each partner is:

A)

Q45: When a new partner is added to

Q48: Discuss the characteristics of partnerships and similar

Q59: In the absence of a partnership agreement,the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents