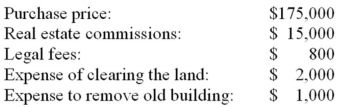

SportsWorld purchased property for a building site.The costs associated with the property were:  What portion of these costs should be allocated to the cost of the land and what portion should be allocated to the cost of the new building?

What portion of these costs should be allocated to the cost of the land and what portion should be allocated to the cost of the new building?

A) $150,000 to Land; $18,800 to Building.

B) $190,000 to Land; $3,800 to Building.

C) $190,800 to Land; $3,000 to Building.

D) $192,800 to Land; $1,000 to Building.

E) $193,800 to Land; $0 to Building.

Correct Answer:

Verified

Q70: A main accounting issue for property,plant and

Q71: A copyright gives its owner the exclusive

Q72: The cost of land can include:

A) Purchase

Q73: The cost of developing,maintaining,or enhancing the value

Q74: Goodwill is an intangible asset.

Q77: Goodwill is depreciated over its useful life

Q77: Property,plant and equipment include:

A) Land.

B) Land improvements.

C)

Q91: SportsWorld purchased property for $100,000.The property included

Q114: Property,plant and equipment are

A)Current assets

B)Used in business

Q116: Property,plant and equipment are

A)Tangible assets used in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents