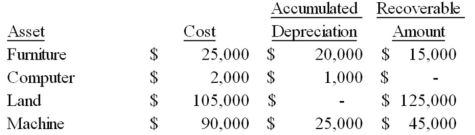

Matador & Company was preparing the annual financial statements and,as part of its year-end procedures,prepared the following schedule based on adjusted values at March 31,2015:  Record the entry for any impairment loss assuming that Matador & Company recorded no impairment losses in previous years.

Record the entry for any impairment loss assuming that Matador & Company recorded no impairment losses in previous years.

Correct Answer:

Verified

Q185: On January 4,2015,SportsWorld purchased a patent for

Q187: The three factors in calculating depreciation are:

Q188: During 2014,Storey Company acquired a new computer

Q189: Hawaii Kai purchased a leasehold property for

Q191: On April 1,Fog Company traded an old

Q192: Record the entry for any impairment loss

Q193: Upside Down Company purchased new office equipment

Q194: Hertzog Company purchased and installed a machine

Q195: _ are costs that increase the usefulness

Q201: Explain what could cause the impairment of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents