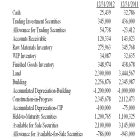

A partial balance sheet for BCS,Inc.for December 31,2012 and December 31,2011 is provided below.You are working on the audit for the 12/31/12 year-end.The 12/31/11 balance sheet numbers were audited by your CPA firm last year.Use the partial balance sheet for BCS provided below.You have been assigned to audit the land,building,and equipment accounts.  a.During the year the company purchased land for $1,000,000.What was the cost of land sold during the year?

a.During the year the company purchased land for $1,000,000.What was the cost of land sold during the year?

b.Can you determine if the land was sold for a gain or a loss? How would you calculate the gain or loss on sale?

c.During the year,the company sold one building and did not purchase any additional buildings.The building sold for $200,000.$60,000 of depreciation had been taken on the building up to the point of the sale.What was the amount of the gain or loss on the sale?

d.If buildings are depreciated over 25 years on a straight-line basis,is the amount of depreciation expense taken in 2012 on the buildings reasonable? Show your calculations to support your answer.e.What audit procedures would you perform to determine that the $1,000,000 assigned to the purchase of the land was correct?

f.What is the GAAP rule for recording fixed asset purchases?

g.What is the GAAP rule for valuing fixed assets at year-end?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q94: The search for unrecorded liabilities is an

Q95: What is the financial statement effect of

Q96: An effective way to identify liabilities that

Q97: An effective way to identify liabilities that

Q97: An effective way to identify liabilities that

Q99: To audit the accrued liabilities of a

Q100: One of the easiest ways to evaluate

Q101: The auditor gathers evidence in the revenue

Q102: Describe the following audit procedures,providing an example

Q104: Auditing has been described as the process

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents