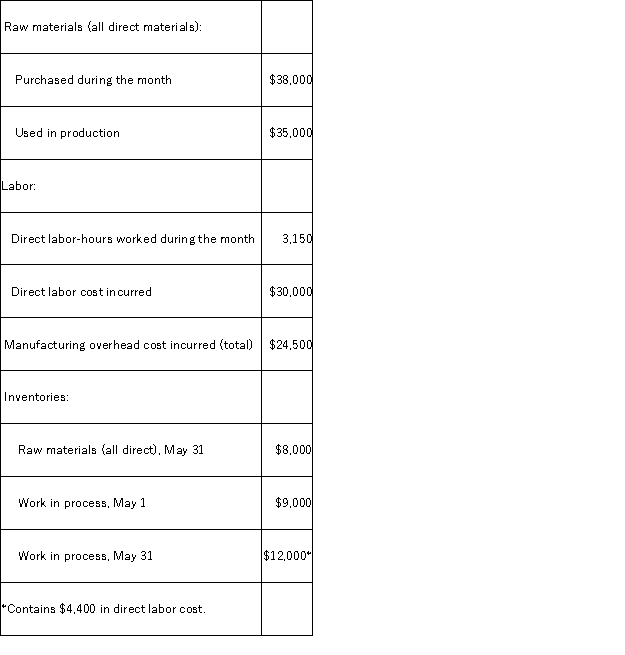

Dillon Corporation applies manufacturing overhead to jobs using a predetermined overhead rate of 75% of direct labor cost.Any under or overapplied manufacturing overhead cost is closed out to Cost of Goods Sold at the end of the month.During May,the following transactions were recorded by the company:  The entry to dispose of the under or overapplied manufacturing overhead cost for the month would include:

The entry to dispose of the under or overapplied manufacturing overhead cost for the month would include:

A) a debit of $2,000 to the Manufacturing Overhead account.

B) a credit of $2,500 to the Manufacturing Overhead account.

C) a debit of $2,000 to Cost of Goods Sold.

D) a credit of $2,500 to Cost of Goods SolD.Overhead over or underapplied

Correct Answer:

Verified

Q102: Tondre Inc.has provided the following data for

Q103: The following partially completed T-accounts summarize transactions

Q104: Dapper Corporation had only one job in

Q105: The following partially completed T-accounts summarize transactions

Q106: Messana Corporation reported the following data for

Q108: The following partially completed T-accounts summarize transactions

Q109: Dapper Corporation had only one job in

Q110: Messana Corporation reported the following data for

Q111: Dillon Corporation applies manufacturing overhead to jobs

Q112: The following partially completed T-accounts summarize transactions

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents