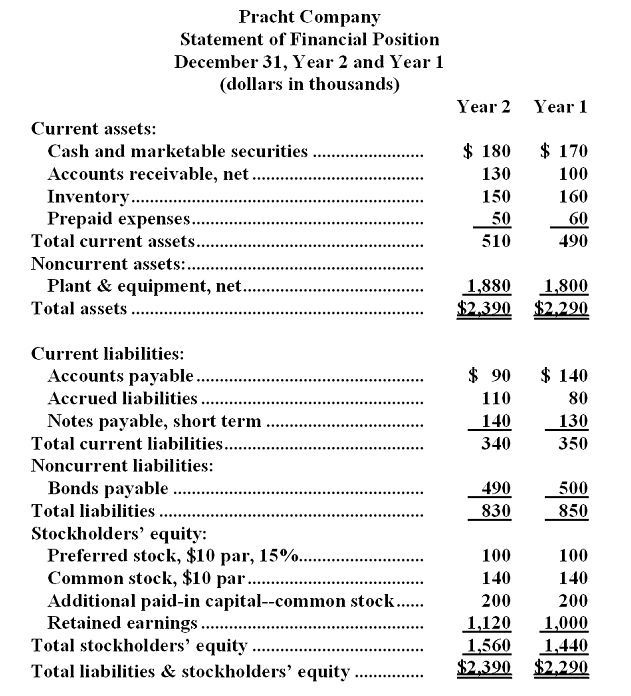

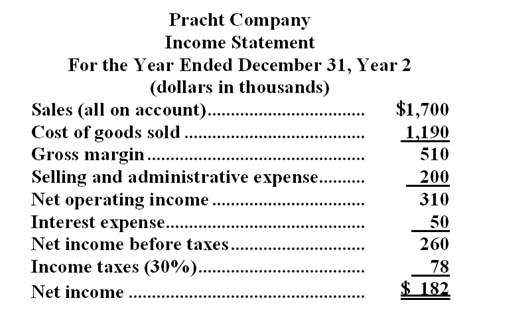

Financial statements for Pracht Company appear below: Pracht Company

Statement of Financial Position

December 31, Year 2 and Year 1

(dollars in thousands)

Dividends during Year 2 totaled $62 thousand,of which $15 thousand were preferred dividends.

The market price of a share of common stock on December 31,Year 2 was $160.

Required:

Compute the following for Year 2:

a.Earnings per share of common stock.

b.Price-earnings ratio.

c.Dividend payout ratio.

d.Dividend yield ratio.

e.Return on total assets.

f.Return on common stockholders' equity.

g.Book value per share.

h.Working capital.

i.Current ratio.

j.Acid-test ratio.

k.Accounts receivable turnover.

l.Average collection period.

m.Inventory turnover.

n.Average sale period.

o.Times interest earned.

p.Debt-to-equity ratio.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q183: Debutiaco Corporation's most recent balance sheet and

Q184: Financial statements for Rarig Company appear below:

Q185: Sweetman Corporation has provided the following

Q186: Lunghofer Corporation's net income for the most

Q187: Data from Paynter Corporation's most recent balance

Q189: Recent financial statements for Madison Company are

Q190: Financial statements for Qualle Company appear below:

Q191: Excerpts from Ruden Corporation's most recent

Q192: Tubergen Corporation's most recent income statement appears

Q193: Eaglen Corporation has provided the following data:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents