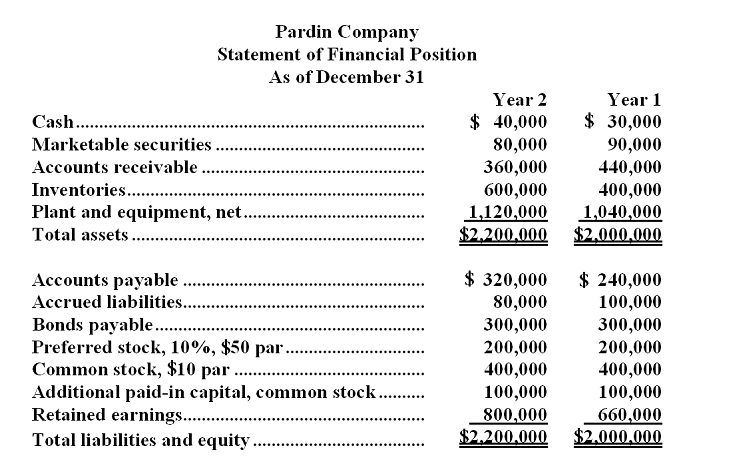

Condensed financial statements for Pardin Company are given below: Pardin Company

Statement of Financial Position

As of December 31

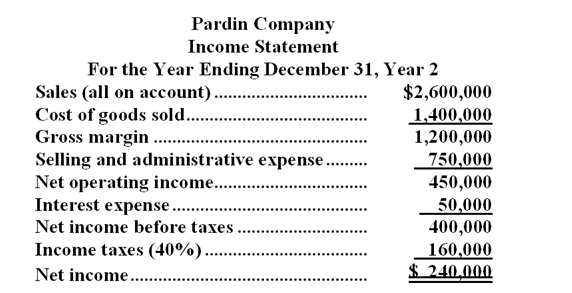

The company paid total dividends of $100,000 during the year.At the end of Year 2,the company's common stock was selling for $38 per share.

Required:

On the basis of the information given above,fill in the blanks with the appropriate figures:

Example: The current ratio at the end of Year 2 would be computed by dividing $1,080,000 by $400,000.

a.The acid-test ratio at the end of Year 2 would be computed by dividing _______________ by _________________.

b.The accounts receivable turnover during Year 2 would be computed by dividing _______________ by _________________.

c.The inventory turnover during Year 2 would be computed by dividing _______________ by _________________.

d.The times interest earned for Year 2 would be computed by dividing _______________ by _________________.

e.The earnings per share of common stock for Year 2 would be computed by dividing _______________ by _________________.

f.The return on total assets for Year 2 would be computed by dividing _______________ by _________________.

g.The debt-to-equity ratio at the end of Year 2 would be computed by dividing _______________ by _________________.

h.The dividend yield ratio would be computed by dividing _______________ by _________________.

i.The return on common stockholders' equity for Year 2 would be computed by dividing _______________ by _________________.

j.Whether the common stockholders gained or lost from the use of financial leverage during Year 2 would be determined by comparing the ratio computed in question ___ above to the ratio computed in question above ____.In this case,financial leverage is (positive/negative)___________________.

Correct Answer:

Verified

b.$2,600,000;$400,0...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q193: Eaglen Corporation has provided the following data:

Q194: Renbud Computer Services Co.(RCS)specializes in customized software

Q195: Basta Corporation's net income last year was

Q196: Malbrough Corporation's most recent balance sheet and

Q197: Condensed financial statements for Blackhurst Company

Q199: Last year,Bickham Corporation's dividend on common stock

Q200: Bedrosian Incorporated has a line of

Q201: Data from Ankeny Corporation's most recent

Q202: Pettengill Corporation's net operating income last year

Q203: Excerpts from Stepney Corporation's most recent balance

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents