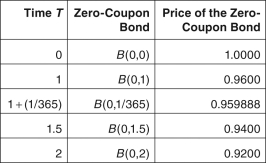

Zero-coupon bond prices are given by B(0,T ) ,where 0 is today,and T (measured in years) is the bond's maturity date.

-Suppose that you compute the simple forward rate over the time period that begins after one year and continues over the next day,and use it as an approximation to the continuously compounded forward rate.Then the value that you obtain is:

A) 0.041667

B) 0.043478

C) 0.042588

D) 0.042553

E) None of these answers are correct.

Correct Answer:

Verified

Q5: Why was Black's model not useful for

Q6: Zero-coupon bond prices are given by B(0,T

Q7: Zero-coupon bond prices are given by B(0,T

Q8: A company buys a caplet today (time

Q9: Which statement in connection with the alleged

Q11: Use the following data for a caplet

Q12: A company buys a caplet today (time

Q13: Use the following data for a caplet

Q14: Use the following data for a caplet

Q15: Suppose that you have computed the historical

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents