Exhibit 20.4.Investment institutions usually have funds with different risk vs.reward prospectuses.A trading magazine wants to determine if the returns of high risk funds is greater than low risk funds.The magazine records the return of high and low risk funds for a sample of 22 institutions.For the Wilcoxon signed-rank test,where D = high risk return - low risk return,the value of the test statistic is  . Refer to Exhibit 20.4.For the Wilcoxon signed-rank test,the competing hypotheses are:

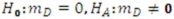

. Refer to Exhibit 20.4.For the Wilcoxon signed-rank test,the competing hypotheses are:

A)

B)

C)

D)

Correct Answer:

Verified

Q31: Exhibit 20.1.A pawn shop claims to sell

Q32: Exhibit 20.2.A trading magazine wants to determine

Q33: Exhibit 20.1.A pawn shop claims to sell

Q34: Exhibit 20.3.A company which produces financial accounting

Q35: Exhibit 20.1.A pawn shop claims to sell

Q37: Exhibit 20.2.A trading magazine wants to determine

Q38: Exhibit 20.2.A trading magazine wants to determine

Q39: Exhibit 20.2.A trading magazine wants to determine

Q40: Exhibit 20.2.A trading magazine wants to determine

Q41: Exhibit 20.4.Investment institutions usually have funds with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents