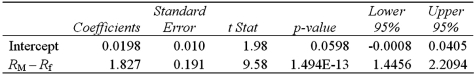

Exhibit 15-6.Tiffany & Co.has been the world's premier jeweler since 1837.The performance of Tiffany's stock is likely to be strongly influenced by the economy.Monthly data for Tiffany's risk-adjusted return and the risk-adjusted market return are collected for a five-year period (n = 60) .The accompanying table shows the regression results when estimating the CAPM model for Tiffany's return.  Refer to Exhibit 15-6.You would like to determine whether an investment in Tiffany's is riskier than the market.When conducting this test,you set up the following competing hypotheses:

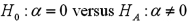

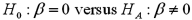

Refer to Exhibit 15-6.You would like to determine whether an investment in Tiffany's is riskier than the market.When conducting this test,you set up the following competing hypotheses:

A)

B)

C)

D)

Correct Answer:

Verified

Q56: A researcher gathers data on 25 households

Q57: For a given confidence level,the prediction interval

Q58: When estimating Q59: Refer to the portion of regression results Q60: Refer to the portion of regression results Q62: Exhibit 15-5.The accompanying table shows the regression Q63: Exhibit 15-6.Tiffany & Co.has been the world's Q64: Exhibit 15-4.A researcher analyzes the factors that Q65: Exhibit 15-5.The accompanying table shows the regression Q66: Exhibit 15-5.The accompanying table shows the regression![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents