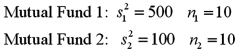

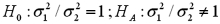

Exhibit 11-6.A financial analyst examines the performance of two mutual funds and claims that the variances of the annual returns for the bond funds differ.To support his claim,he collects data on the annual returns (in percent) for the years 2001 through 2010.The analyst assumes that the annual returns for the two emerging market bond funds are normally distributed.Here are some relevant summary statistics.  Refer to Exhibit 11-6.For the competing hypotheses:

Refer to Exhibit 11-6.For the competing hypotheses:  since

since  ,approximate the p-value for the test.

,approximate the p-value for the test.

A) Less than 0.01

B) Between 0.01 and 0.025

C) Between 0.02 and 0.05

D) Between 0.05 and 0.10

Correct Answer:

Verified

Q71: Exhibit 11-5.Amie Jackson,a manager at Sigma travel

Q72: Consider the following hypotheses: Q73: Exhibit 11-6.A financial analyst examines the performance Q74: The following table shows the annual returns Q75: Find the value x for which: Q77: Exhibit 11-6.A financial analyst examines the performance Q79: The following data,drawn from a normal population,is Q80: Consider the following hypotheses: Q81: The following are the measures based on Q99: The sample mean and the sample standard![]()

A) ![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents