A particular bank has two loan modification programs for distressed borrowers: Home Affordable Modification Program (HAMP) modifications,where the federal government pays the bank $1,000 for each successful modification,and non-HAMP modifications,where the bank does not receive a bonus from the federal government.In order to qualify for a HAMP modification,borrowers must meet a set of financial suitability criteria.Define the null and alternative hypotheses to test whether borrowers who receive HAMP modifications default less than borrowers who receive non-HAMP modifications.Let  and

and  represent the proportion of borrowers who received HAMP modifications that did not re-default,and the proportion of borrowers who received non-HAMP modifications that did not re-default,respectively

represent the proportion of borrowers who received HAMP modifications that did not re-default,and the proportion of borrowers who received non-HAMP modifications that did not re-default,respectively

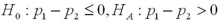

A)

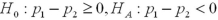

B)

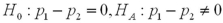

C)

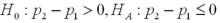

D)

Correct Answer:

Verified

Q57: Exhibit 10.4.A 7000-seat theater is interested in

Q58: Exhibit 10.3.A restaurant chain has two locations

Q59: Exhibit 10.7.A stats professor at a large

Q60: Exhibit 10.6.A university wants to compare out-of-state

Q61: Exhibit 10.9.A tutor promises to improve GMAT

Q63: Exhibit 10.9.A tutor promises to improve GMAT

Q64: Exhibit 10.11.The student senate at a local

Q65: Exhibit 10.12.A veterinarian wants to know if

Q66: Exhibit 10.12.A veterinarian wants to know if

Q67: Exhibit 10.11.The student senate at a local

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents