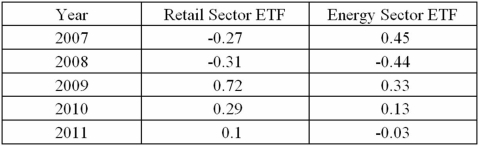

The following is return data for a Retail sector ETF and Energy Sector ETF for the years 2007 through 2011.  a.What is the arithmetic mean return for each ETF?

a.What is the arithmetic mean return for each ETF?

B)What is the geometric mean return for each ETF?

C)What is the sample standard deviation for each ETF? Which ETF was riskier over this time period?

D)Given a risk free rate of 5%.What is the Sharpe Ratio for each ETF? Which investment had a better return per unit of risk over this time period?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q98: When interpreting the covariance between variables x

Q99: Professors at a local university earn an

Q101: The following is a list of GPA

Q105: The following data is a list of

Q106: What does the covariance measure?

A) The direction

Q106: The following is summary measures for Google

Q108: The following data represents motor vehicle theft

Q135: The following represent the sizes of fleece

Q137: John lives in Los Angeles and hates

Q152: Your used car is expected to last

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents