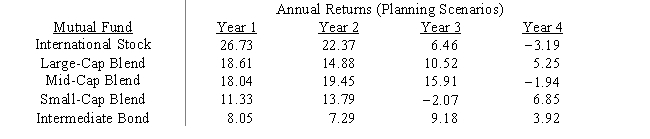

Investment manager Max Gaines wishes to develop a mutual fund portfolio based on the Markowitz portfolio model.He needs to determine the proportion of the portfolio to invest in each of the five mutual funds listed below so that the variance of the portfolio is minimized subject to the constraint that the expected return of the portfolio be at least 4%.Formulate the appropriate nonlinear program.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: The measure of risk most often associated

Q23: A convex function is

A)bowl-shaped up.

B)bowl-shaped down.

C)elliptical in

Q24: Which of the following statements is incorrect?

A)A

Q25: It is common that components that are

Q26: If the coefficient of each squared term

Q28: The Markowitz mean-variance portfolio model presented in

Q29: Financial planner Minnie Margin wishes to develop

Q30: When components share a storage facility,they are

Q31: Which of the following is NOT true

Q32: In the Bass model for forecasting the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents