Exhibit 14-2

-The employee pays the greatest amount of the payroll tax when

A) labor supply is relatively inelastic.

B) labor demand is inelastic.

C) the employee and employer each write a check to the government for half of the tax.

D) the employee writes the check to the government.

E) the employer writes the check to the government.

Correct Answer:

Verified

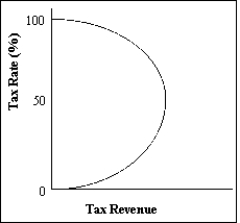

Q54: Refer to the figure below. Which of

Q55: In the case of a per-unit tax

Q56: Exhibit 14-2 Q57: Which of the following statements is true? Q58: Taxes cause deadweight losses because they Q60: Which of the following conditions results in Q61: In designing a tax system, the government Q62: Which of the following are tradeoffs in Q63: According to the ability-to-pay principle, Q64: To minimize inefficiency from taxes on goods,![]()

A)When

A)raise market

A)those with lower

A)a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents