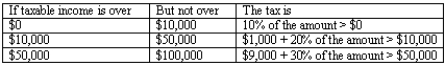

Consider the following income tax schedule for a married couple who are combining their incomes and filing jointly:  (A)What is the tax owed by the couple if each partner earns $20,000?

(A)What is the tax owed by the couple if each partner earns $20,000?

(B)Compare the tax that the couple would pay if they were not married (filing as single)with the amount of tax they pay as a married couple (filing jointly).

(C)What is the tax owed by a couple in which one spouse earns $40,000 and the other spouse earns no income?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q154: As a result of government tax and

Q162: Why doesn't a Lorenz curve ever bow

Q170: The table below gives the income distribution

Q172: Analyze the distribution of household incomes given

Q174: The table below gives hours worked per

Q175: Many politicians argue against taxing home heating

Q178: Suppose a country is concerned about providing

Q179: U.S. government tax and transfer policies have

Q179: Consider the following personal income tax schedule

Q180: Given the data in the table below,draw

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents