Declining Balance Depreciation On July 6,2014,Grayson Purchased New Machinery with an Estimated Useful

Declining balance depreciation

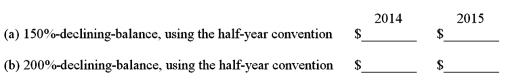

On July 6,2014,Grayson purchased new machinery with an estimated useful life of 10 years.The cost of the equipment was $80,000,with a residual value of $8,000.

Compute the depreciation on this machinery in 2014 and 2015 using each of the following methods.

Correct Answer:

Verified

Q125: Briefly explain the difference between a revenue

Q126: Effects of depreciation on income and cash

Q133: The following expenditures are related to land,land

Q134: Various depreciation methods-first year

On September 5,2015,Apollo purchased

Q137: Trade-ins

Dietz owned a delivery van with a

Q138: Various depreciation methods--two years

On September 6,2014,East River

Q139: Various depreciation methods-first year

On March 24,2015 Tastee

Q140: Depreciation in financial statements

Dynasty Co.uses straight-line depreciation

Q141: Caan purchased the Stokes Mine for $60

Q147: Computation of goodwill

Chopin Corporation has net assets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents