Financial assets-effects of transactions

Five events involving financial assets are described below:

(a.)Sold merchandise on account.

(b.)Sold available for sale marketable securities at a gain.Cash proceeds from the sale were equal to the current market value of the securities reflected in the last balance sheet.

(c.)Collected an account receivable.

(d.)Adjusted the allowance for doubtful accounts to reflect the portion of accounts receivable estimated to be uncollectible at year-end.

(e.)Made the fair value accounting adjustment reducing the balance in the available for sale marketable securities account to reflect a decrease in the market value of securities owned.

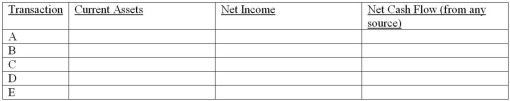

Indicate the effects of each independent transaction or adjusting entry upon the financial measurements shown in the column headings below.Use the code letters,I for increase,D for decrease,and NE for no effect.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q147: Stanley,Inc.'s 2015 income statement reported net sales

Q153: Match the following terms with the explanations

Q154: Watins,Inc.'s 2015 income statement reported net sales

Q161: Silver Company received a two-month,6% note for

Q163: Gold Company received a two-month,12% note for

Q164: In regard to the accounts receivable turnover

Q166: The accounts receivable turnover rate for Baldwin

Q168: If a 5%,four-month note receivable is acquired

Q176: Dorfmann Industries has an accounts receivable turnover

Q179: If a 15%,two-month note receivable is acquired

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents