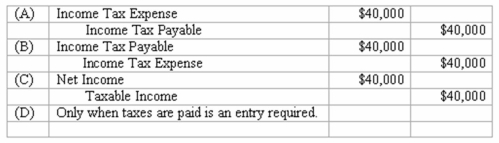

The adjusting entry to recognize income taxes due on a profit of $100,000 and a tax rate of 40% is:

A) A Above.

B) B Above.

C) C Above.

D) D Above.

Correct Answer:

Verified

Q27: Partner A earns $68,000 from a partnership.Partner

Q29: Paid-in Capital

A)The lifetime earnings of the corporation.

B)The

Q30: Double Taxation means:

A)A corporation must pay double

Q30: When deciding the form of organization of

Q34: In order to form a corporation,the corporation

Q35: The Board of Directors of a corporation:

A)Are

Q36: Salary allowances to partners when dividing net

Q36: Income taxes to a partnership:

A)Are an obligation

Q37: In a sole proprietorship the balance in

Q37: Retained Earnings represent:

A)The profits of the company.

B)The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents