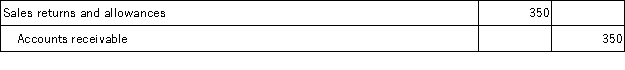

On July 1, Ferguson Company, Inc. sold merchandise in the amount of $3,700 to Tracey Company, with credit terms of 2/10, n/30. The cost of the items sold is $2,000. Ferguson uses the gross method of accounting for sales and a perpetual inventory system. On July 5, Tracey returns some of the merchandise. The selling price of the merchandise returned is $500 and the cost of the merchandise returned is $350. The entry or entries that Ferguson must make on July 5 to record the return is:

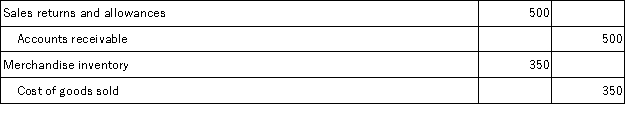

A)

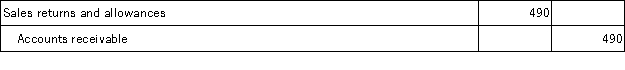

B)

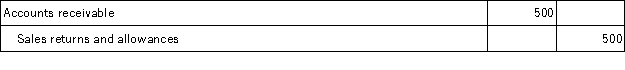

C)

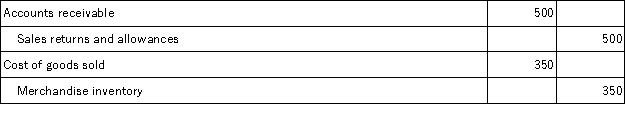

D)

E)

Correct Answer:

Verified

Q43: All of the following statements regarding inventory

Q53: Expenses that support the overall operations of

Q90: Sales less sales discounts less sales returns

Q118: A company that uses the gross method

Q120: A company that uses a perpetual inventory

Q123: Frisco Company Inc.'s Merchandise Inventory account at

Q125: Expenses to promote sales by displaying and

Q126: Juniper Company, Inc. uses a perpetual inventory

Q127: On February 3, Smart Company, Inc. sold

Q182: A company that uses the net method

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents