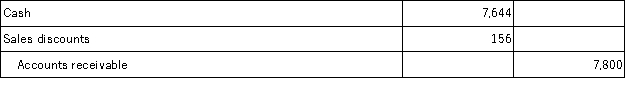

On March 12, Masterson Company, Inc. sold merchandise in the amount of $7,800 to Forsythe Company, with credit terms of 2/10, n/30. The cost of the items sold is $4,500. Masterson uses the gross method of accounting for sales and a perpetual inventory system. On March 15, Forsythe was given an allowance of $600 on defective merchandise that had a cost of $350. Forsythe pays the invoice on March 20, and takes the appropriate discount. The journal entry that Masterson makes on March 20 is:

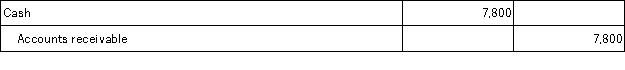

A)

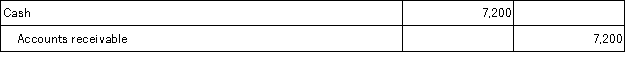

B)

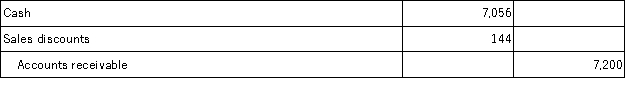

C)

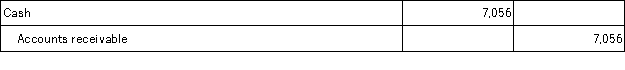

D)

E)

Correct Answer:

Verified

Q70: A company has net sales of $825,000

Q172: On March 12, Klein Company, Inc. sold

Q173: On March 12, Klein Company, Inc. sold

Q175: Wellington Company had sales this year of

Q176: On March 12, Masterson Company, Inc. sold

Q178: On March 12, Masterson Company, Inc. sold

Q179: Zenith Company Inc.'s Merchandise Inventory account at

Q189: Explain the way in which costs flow

Q191: Describe the difference between wholesalers and retailers.

Q198: Distinguish between selling expenses and general and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents