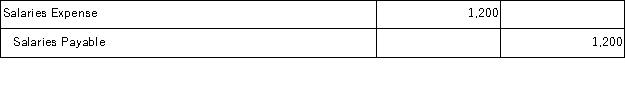

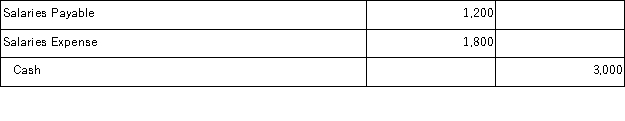

An adjusting entry was made on year-end December 31 to accrue salary expense of $1,200. Which of the following entries would be prepared to record the $3,000 payment of salaries in January of the following year assuming reversing entries were not made?

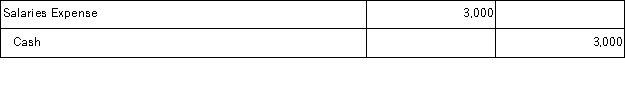

A)

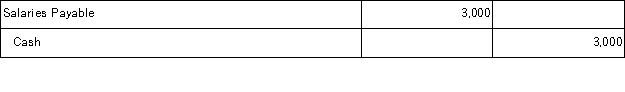

B)

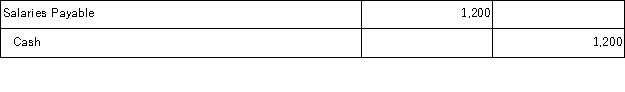

C)

D)

E)

Correct Answer:

Verified

Q74: The difference between the cost of an

Q76: On May 1,Sellers Marketing Company received $1,500

Q84: A company made no adjusting entry for

Q88: On April 1,Griffith Publishing Company received $1,548

Q93: A company purchased new furniture at a

Q95: On April 1,Santa Fe,Inc.paid Griffith Publishing Company

Q106: Which of the following statements related to

Q108: A company pays each of its two

Q127: On December 31,2015 Carmack Company received a

Q146: The adjusting entry to record an accrued

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents