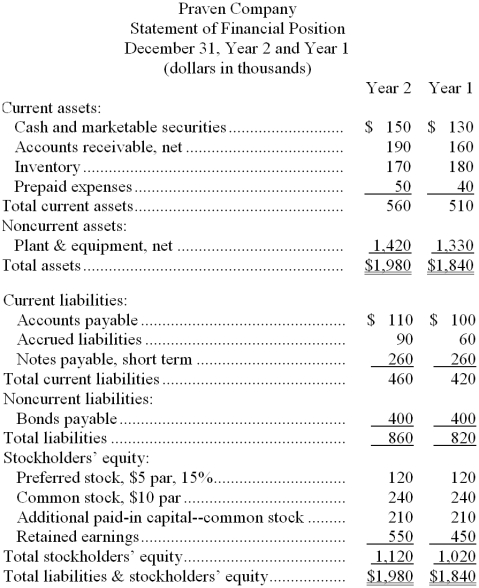

Financial statements for Praven Company appear below:

Dividends during Year 2 totaled $89 thousand, of which $18 thousand were preferred dividends. The market price of a share of common stock on December 31, Year 2 was $130.

Required:

Compute the following for Year 2:

a. Earnings per share of common stock.

b. Price-earnings ratio.

c. Dividend payout ratio.

d. Dividend yield ratio.

e. Return on total assets.

f. Return on common stockholders' equity.

g. Book value per share.

h. Working capital.

i. Current ratio.

j. Acid-test ratio.

k. Accounts receivable turnover.

l. Average collection period.

m. Inventory turnover.

n. Average sale period.

o. Times interest earned.

p. Debt-to-equity ratio.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q176: Excerpts from Deandrade Corporation's most recent balance

Q177: Financial statements for Nardella Company appear below:

Q178: Data from Gofman Corporation's most recent balance

Q179: Shull Corporation's most recent balance sheet and

Q180: Walp Corporation's most recent balance sheet and

Q182: Ducey Corporation's total current assets are $250,000,

Q183: Excerpts from Dinis Corporation's most recent balance

Q184: Financial statements for Qiang Company appear below:

Q185: Data from Panganiban Corporation's most recent balance

Q186: Odegaard Corporation's net income last year was

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents