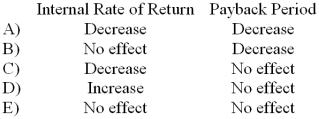

Rennin Dairy Corporation is considering a plant expansion decision that has an estimated useful life of 20 years. This project has an internal rate of return of 15% and a payback period of 9.6 years. How would a decrease in the expected salvage value from this project in 20 years affect the following for this project?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

Correct Answer:

Verified

Q12: An investment project that requires a present

Q13: One strength of the simple rate of

Q14: In capital budgeting decisions, a $10,000 decrease

Q15: The payback method measures:

A) how quickly investment

Q16: A project profitability index greater than zero

Q18: A weakness of the internal rate of

Q19: In preference decision situations, a project with

Q20: The total-cost approach and the incremental-cost approach

Q21: (Ignore income taxes in this problem.) The

Q22: (Ignore income taxes in this problem.) Given

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents