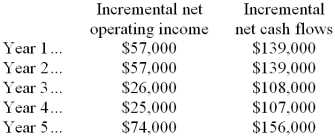

(Ignore income taxes in this problem.) Steinmann Inc. is considering the acquisition of a new machine that costs $410,000 and has a useful life of 5 years with no salvage value. The incremental net operating income and incremental net cash flows that would be produced by the machine are:

-If the discount rate is 14%, the net present value of the investment is closest to:

A) $410,000

B) $239,000

C) $446,002

D) $36,141

Correct Answer:

Verified

Q58: (Ignore income taxes in this problem.) Burwinkel

Q59: (Ignore income taxes in this problem.) The

Q60: (Ignore income taxes in this problem) Digrande

Q61: (Ignore income taxes in this problem.) Steinmann

Q62: (Ignore income taxes in this problem.) Isomer

Q66: (Ignore income taxes in this problem.) Steinmann

Q67: (Ignore income taxes in this problem.) Isomer

Q68: (Ignore income taxes in this problem.) Steinmann

Q120: (Ignore income taxes in this problem.) Joetz

Q136: (Ignore income taxes in this problem.) Treads

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents