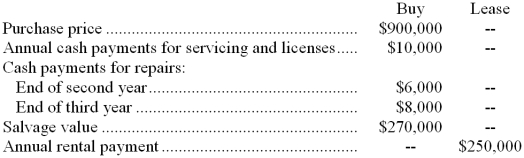

(Ignore income taxes in this problem.) The Wisbley Company is contemplating the purchase of a helicopter for its executives to use in their business trips. This helicopter could be either purchased or leased from the manufacturer. The useful life of the helicopter is four years. Data concerning these two alternatives follow:  If the helicopter is leased, it would be returned to the manufacturer in four years. Wisbley's required rate of return is 22%.

If the helicopter is leased, it would be returned to the manufacturer in four years. Wisbley's required rate of return is 22%.

-The present value of the salvage value of the helicopter, if the helicopter is purchased, would be:

A) $121,770

B) $162,360

C) $114,210

D) $99,900

Correct Answer:

Verified

Q92: (Ignore income taxes in this problem.) The

Q93: (Ignore income taxes in this problem.) The

Q94: (Ignore income taxes in this problem.) Anne,

Q95: (Ignore income taxes in this problem.) Anne,

Q96: (Ignore income taxes in this problem.) Stern

Q98: (Ignore income taxes in this problem.) The

Q99: (Ignore income taxes in this problem.) The

Q100: (Ignore income taxes in this problem.) The

Q101: (Ignore income taxes in this problem.) Prince

Q102: (Ignore income taxes in this problem.) The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents