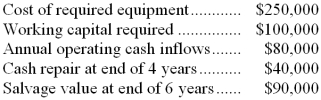

(Ignore income taxes in this problem.) The Becker Company is interested in buying a piece of equipment that it needs. The following data have been assembled concerning this equipment:  This equipment is expected to have a useful life of 6 years. At the end of the sixth year the working capital would be released for use elsewhere. The company's discount rate is 10%.

This equipment is expected to have a useful life of 6 years. At the end of the sixth year the working capital would be released for use elsewhere. The company's discount rate is 10%.

-The present value of all future operating cash inflows is closest to:

A) $480,000

B) $452,300

C) $348,400

D) $278,700

Correct Answer:

Verified

Q82: (Ignore income taxes in this problem.) Eckels

Q83: (Ignore income taxes in this problem.) The

Q84: (Ignore income taxes in this problem.) The

Q85: (Ignore income taxes in this problem.) Stern

Q86: (Ignore income taxes in this problem.) The

Q88: (Ignore income taxes in this problem.) Gimar

Q89: (Ignore income taxes in this problem.) Gimar

Q90: (Ignore income taxes in this problem.) The

Q91: (Ignore income taxes in this problem.) Bleeker

Q92: (Ignore income taxes in this problem.) The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents