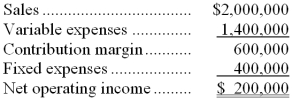

(Ignore income taxes in this problem.) Ursus, Inc., is considering a project that would have a ten-year life and would require a $1,000,000 investment in equipment. At the end of ten years, the project would terminate and the equipment would have no salvage value. The project would provide net operating income each year as follows:

All of these items, except for depreciation of $100,000 a year, represent cash flows. The depreciation is included in the fixed expenses. The company's required rate of return is 12%.

Required:

a. Compute the project's net present value.

b. Compute the project's internal rate of return to the nearest whole percent.

c. Compute the project's payback period.

d. Compute the project's simple rate of return.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q101: sales and expenses are projected:

Q109: (Ignore income taxes in this problem.) The

Q110: (Ignore income taxes in this problem.) Furner

Q111: (Ignore income taxes in this problem.) The

Q113: (Ignore income taxes in this problem.) The

Q115: (Ignore income taxes in this problem.) Purvell

Q116: (Ignore income taxes in this problem.) Corin

Q117: (Ignore income taxes in this problem.) Dilworth

Q118: (Ignore income taxes in this problem.) Masone

Q119: (Ignore income taxes in this problem.) Bradley

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents