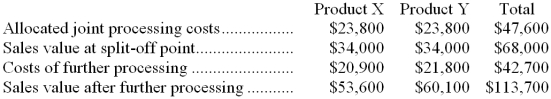

Iacollia Company makes two products from a common input. Joint processing costs up to the split-off point total $47,600 a year. The company allocates these costs to the joint products on the basis of their total sales values at the split-off point. Each product may be sold at the split-off point or processed further. Data concerning these products appear below:

Required:

a. What is the net monetary advantage (disadvantage) of processing Product X beyond the split-off point?

b. What is the net monetary advantage (disadvantage) of processing Product Y beyond the split-off point?

c. What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?

d. What is the minimum amount the company should accept for Product Y if it is to be sold at the split-off point?

Correct Answer:

Verified

Q121: A customer has asked Clougherty Corporation to

Q122: Gloster Company makes three products in a

Q123: Veron Corporation purchases potatoes from farmers. The

Q124: Closter Corporation makes three products that use

Q125: Ries Corporation has received a request for

Q126: Manning Co. manufactures and sells trophies for

Q127: Hon Company makes three products in a

Q128: The constraint at Crumedy Inc. is an

Q129: Policastro Corporation produces two intermediate products, A

Q131: Witch's Brew Company manufactures and sells three

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents