Dilom Farm Supply is located in a small town in the rural west. Data regarding the store's operations follow:

Sales are budgeted at $260,000 for November, $230,000 for December, and $210,000 for January.

Collections are expected to be 55% in the month of sale, 40% in the month following the sale, and 5% uncollectible.

The cost of goods sold is 80% of sales.

The company purchases 50% of its merchandise in the month prior to the month of sale and 50% in the month of sale. Payment for merchandise is made in the month following the purchase.

Other monthly expenses to be paid in cash are $21,700.

Monthly depreciation is $17,000.

Ignore taxes.

-Expected cash collections in December are:

A) $126,500

B) $230,500

C) $104,000

D) $230,000

Correct Answer:

Verified

Q46: Golebiewski Inc. bases its manufacturing overhead budget

Q47: Justin's Plant Store, a retailer, started operations

Q48: Roufs Inc. bases its selling and administrative

Q49: Justin's Plant Store, a retailer, started operations

Q50: The Stacy Company makes and sells a

Q52: Noskey Corporation is a merchandising firm. Information

Q53: The selling and administrative expense budget of

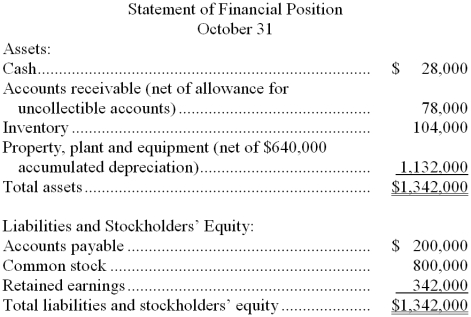

Q54: Dilom Farm Supply is located in a

Q55: Noskey Corporation is a merchandising firm. Information

Q56: The manufacturing overhead budget at Ferrucci Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents