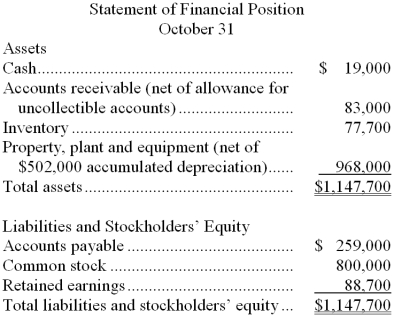

Carner Lumber sells lumber and general building supplies to building contractors in a medium-sized town in Montana. Data regarding the store's operations follow:

Sales are budgeted at $370,000 for November, $360,000 for December, and $340,000 for January.

Collections are expected to be 85% in the month of sale, 13% in the month following the sale, and 2% uncollectible.

The cost of goods sold is 70% of sales.

The company purchases 30% of its merchandise in the month prior to the month of sale and 70% in the month of sale. Payment for merchandise is made in the month following the purchase.

Other monthly expenses to be paid in cash are $24,600.

Monthly depreciation is $17,000.

Ignore taxes.

-The net income for December would be:

A) $59,200

B) $83,400

C) $66,400

D) $72,600

Correct Answer:

Verified

Q133: A sales budget is given below for

Q134: TabComp Inc. is a retail distributor for

Q135: Gokey Inc. bases its manufacturing overhead budget

Q136: Carner Lumber sells lumber and general

Q137: Glinski Corporation is working on its direct

Q139: Weltin Industrial Gas Corporation supplies acetylene and

Q140: Carner Lumber sells lumber and general

Q141: Borling Inc. bases its selling and administrative

Q142: The selling and administrative expense budget of

Q143: Payment Inc. is preparing its cash budget

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents