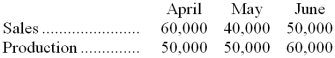

Carter Company has projected sales and production in units for the second quarter of next year as follows:

Required:

a. Cash production costs are budgeted at $6 per unit produced. Of these production costs, 40% are paid in the month in which they are incurred and the balance in the following month. Selling and administrative expenses (all of which are paid in cash) amount to $120,000 per month. The accounts payable balance on March 31 totals $192,000, all of which will be paid in April. Prepare a schedule for each month showing budgeted cash disbursements for Carter Company.

b. Assume that all units will be sold on account for $15 each. Cash collections from sales are budgeted at 60% in the month of sale, 30% in the month following the month of sale, and the remaining 10% in the second month following the month of sale. Accounts receivable on March 31 totaled $510,000 $(90,000 from February's sales and the remainder from March). Prepare a schedule for each month showing budgeted cash receipts for Carter Company.

Correct Answer:

Verified

Q120: The LFM Company makes and sells a

Q121: The manufacturing overhead budget of Inch Corporation

Q122: Deviney Corporation is working on its direct

Q123: Crose Inc. is working on its cash

Q124: Tilson Company has projected sales and production

Q126: Carner Lumber sells lumber and general

Q127: Carner Lumber sells lumber and general

Q129: Palmerin Corporation is preparing its cash budget

Q130: Capid Corporation is a wholesaler of

Q147: The Adams Corporation, a merchandising firm, has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents