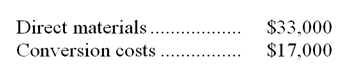

A sporting goods manufacturer buys wood as a direct material for baseball bats. The Forming Department processes the baseball bats, and the bats are then transferred to the Finishing Department where a sealant is applied. There was no beginning work in process inventory in the Forming Department in May. The Forming Department began manufacturing 10,000 Casey Slugger baseball bats during May. Costs for the Forming Department for the month of May were as follows:

A total of 8,000 bats were completed and transferred to the Finishing Department during May. The ending work in process inventory was 100% complete with respect to direct materials and 25% complete with respect to conversion costs. The company uses the weighted-average method of process costing.

-The cost of the units transferred to the Finishing Department during May was:

A) $50,000

B) $40,000

C) $53,000

D) $42,400

Correct Answer:

Verified

Q22: Strap Company uses the weighted-average method in

Q23: Raulot Corporation uses the weighted-average method in

Q26: A sporting goods manufacturer buys wood as

Q28: Natraj Corporation uses the weighted-average method in

Q29: In July, one of the processing departments

Q30: Abis Corporation uses the weighted-average method in

Q31: Yimron Corporation uses the weighted-average method in

Q32: Abis Corporation uses the weighted-average method in

Q73: Sumter Corporation uses the weighted-average method in

Q74: Sumter Corporation uses the weighted-average method in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents