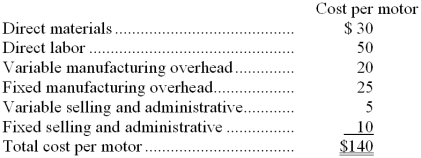

The Commando Motorcycle Company has decided to become decentralized and split its operations into two divisions, Motor and Assembly. Both divisions will be treated as investment centers. The Motor Division is currently operating at its capacity of 30,000 motors per year. Motor's costs at this level of production are as follows:  Motor sells 10,000 of its motors to a snowmobile manufacturer and transfers the remaining 20,000 motors to the Assembly Division. The two divisions are currently in a debate over an appropriate transfer price to charge for the 20,000 motors. Motor currently charges the snowmobile manufacturer $200 per motor. The final selling price of the motorcycles that Commando produces is $7,200 per cycle. This selling price will not change regardless of the transfer price charged between the two divisions. Motor has no market for the 20,000 motors if they are not transferred to Assembly. Variable selling and administrative costs are incurred on both internal and external sales.

Motor sells 10,000 of its motors to a snowmobile manufacturer and transfers the remaining 20,000 motors to the Assembly Division. The two divisions are currently in a debate over an appropriate transfer price to charge for the 20,000 motors. Motor currently charges the snowmobile manufacturer $200 per motor. The final selling price of the motorcycles that Commando produces is $7,200 per cycle. This selling price will not change regardless of the transfer price charged between the two divisions. Motor has no market for the 20,000 motors if they are not transferred to Assembly. Variable selling and administrative costs are incurred on both internal and external sales.

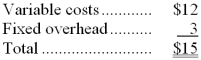

-The Pump Division of Nord Co. produces pumps which it sells for $20 each to outside customers. The pump Division's cost per pump, based on normal volume of 500,000 units per period, is shown below:

Nord has recently purchased a small company which makes automatic dishwashers. This new company is presently purchasing 100,000 pumps each year from another manufacturer. Since the Pump Division has a capacity of 600,000 pumps per year and is now selling only 500,000 pumps to outside customers, management would like the new Dishwasher Division to begin purchasing its pumps internally. The Dishwasher Division is now paying $20 per pump, less a 10% quantity discount. The Pump Division could avoid $1 per unit in variable costs on any sales to the Dishwasher Division.

Required:

a. Treating each division as an independent profit center, within what price range should the internal sales price fall?

b. Now assume that the Pump Division is selling 600,000 pumps per year on the outside. Determine the appropriate transfer price. Show all computations.

(Note: Due limitations in fonts and word processing software, > and < signs must be used in this solution rather than "greater than or equal to" and "less than or equal to" signs.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: One advantage of using actual cost incurred

Q8: A division of a company has idle

Q9: Part WY4 costs the Eastern Division of

Q10: Managers sometimes do not act in ways

Q11: The Commando Motorcycle Company has decided to

Q13: The Commando Motorcycle Company has decided to

Q14: The Commando Motorcycle Company has decided to

Q15: Division A makes a part with the

Q16: The Buffalo Division of Alfred Products, Inc.

Q17: Division A makes a part with the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents