The following information relates to questions 20 to 22

Aussie Ltd has a controlling interest in Pommie Plc. On 1 June 20X5 Pommie sold inventory to Aussie for 10 000 pounds. The inventory was originally acquired by Pommie on 18 May 20X5 for 7000 pounds. The entire amount of inventory was held by Aussie at 30 June 20X5. The Australian tax rate is 30% and the British tax rate is 35%.

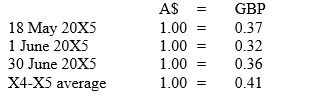

Exchange rates are as follows:

-The credit to cost of goods sold to eliminate the intragroup sale (to the nearest whole dollar) is:

A) A$2 240

B) A$9 375

C) A$17 073

D) A$21 875

Correct Answer:

Verified

Q1: The following information relates to question

Q3: When translating into the functional currency monetary

Q7: Indicators pointing towards the local overseas currency

Q11: Post-acquisition date retained earnings that are denominated

Q11: The general rule for translating liabilities denominated

Q13: Monetary items are best described as:

A) plant

Q17: By applying the definition provided in IAS

Q18: When translating the revenue and expenses in

Q19: When translating into the functional currency foreign

Q20: When translating into the presentation currency the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents