The following information relates to questions 17 to 21

Waratah Ltd acquired a 60% ownership interest in Bottle Brush Ltd on 30 June 2013. On the same day, Bottle Brush Ltd acquired a 70% ownership interest in Honeydew Ltd.

The following interentity transactions have taken place between the entities in the group during the years ended 30 June 2014 and 30 June 2015:

On 1 July 2013 Bottle Brush sold an item of plant to Honeydew for a profit of $20 000. The remaining useful life of the plant at the date of transfer was 4 years.

On 1 September 2013, Honeydew paid a dividend of $70 000 from profits earned since 30 June 2013.

Waratah lent $50 000 to Bottle Brush on 1 January 2014. Interest charged on the loan for the year ended 30 June 2014 was $2000 and for the year ended 30 June 2015 was $4000.

On 31 May 2014 Honeydew sold inventory to Waratah for $15,000. Profit earned on the sale was $5000. Waratah sold the inventory to external parties on 1 August 2014.

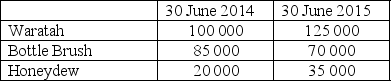

Details of profits earned by entities within the group for the years ended 30 June 2014 and 30 June 2015 are:

The tax rate is 30%.

-The NCI share of profit in Honeydew for the year ended 30 June 2014 is:

A) $4 950

B) $6 000

C) $9 570

D) $11 600

Correct Answer:

Verified

Q1: Which of the following cannot result in

Q7: The indirect non-controlling interest,in a group that

Q12: When calculating the indirect non-controlling interest share

Q14: An ownership structure in which Orange Limited

Q15: The following information relates to questions

Q15: A Limited has a 60% ownership interest

Q17: Use the information below to answer questions

Q19: The following information relates to questions

Q21: When preparing consolidation adjustment entries to effect

Q39: In a multiple subsidiary structure, the direct

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents