A Ltd sold an item of plant to B Ltd on 1 January 20X7 for $25 000. The asset had cost A Ltd $30 000 when acquired on 1 January 20X5. At that time the useful life of the plant was assessed at 6 years. The consolidation elimination entries at 30 June 20X7 in relation to the sale of plant is (rounded to nearest dollar) :

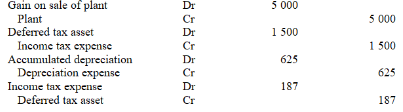

A)

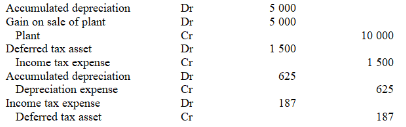

B)

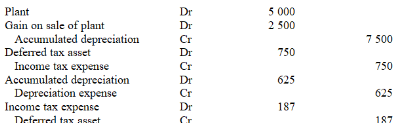

C)

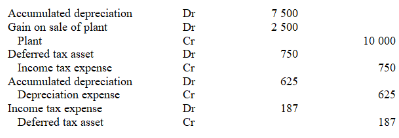

D)

Correct Answer:

Verified

Q3: A subsidiary sold inventory to a parent

Q4: A consolidation worksheet adjustment to eliminate the

Q7: A parent entity group sold a depreciable

Q8: If a dividend is paid out of

Q11: When eliminating an intragroup service which of

Q13: A Ltd sold an item of plant

Q16: A consolidation adjustment entry made to eliminate

Q20: A subsidiary entity sold goods to its

Q22: If an entity sells a non-current asset

Q23: On 16 May 20X4, Z Ltd sold

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents