Use the following information to answer questions 6 to 8.

A company's capital consists of 50 000 ordinary shares issued at $2 and paid to $1 per share.

On 1 September, a first call of 50c was made on the ordinary shares. By 30 September, the call money received amounted to $22 500. No further payments were received, and on 31 October, the shares on which calls were outstanding were forfeited. On 15 November, the forfeited shares were reissued as paid to $1.50 for a payment of $1 per share. The appropriate cash amount from the reissue was received on 19 November. Costs of reissue amounted to $2 000. The company's constitution provided for any surplus on resale, after satisfaction of unpaid calls, accrued interest and costs, to be returned to the shareholders whose shares were forfeited.

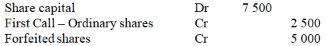

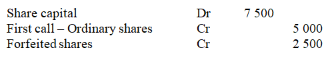

-The entry to record the forfeiture of shares is:

Learning Objective 2.5 Account for the issue of both par value and no-par shares

A)

B)

C)

D)

Correct Answer:

Verified

Q2: The balance in the retained earnings account

Q6: In respect to the issue of shares

Q6: ABC Ltd was registered as a corporation

Q7: Laws in relation to share buy-backs are

Q8: Use the following information to answer questions

A

Q8: Valdez Limited issued 10 000 share options

Q9: If the balance in a forfeited shares

Q10: Dividends declared after the balance date but

Q15: The bonus issue of shares has the

Q19: In relation to an asset revaluation surplus,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents