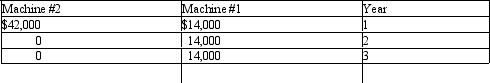

Woody Manufacturing Inc. is considering the purchase of a new machine. They have narrowed their choices down to two machines, Machine #1 and Machine #2, each having a cost of $35,000. The following information is available regarding the expected cash inflows from each machine:  When using net present value analysis, Woody uses the same cost of capital for both machines and both machines have a positive net present value.

When using net present value analysis, Woody uses the same cost of capital for both machines and both machines have a positive net present value.

Based on the above information, which of the following statements is true?

A) Machine #1 will have a higher net present value than Machine #2.

B) Machine #1 will have a lower net present value than Machine #2.

C) Machines #1 and #2 will have the same net present values.

D) Machines #1 and #2 will have the same internal rates of return.

Correct Answer:

Verified

Q14: If an investment's net present value is

Q15: When using the NPV method, the interest

Q16: Which of the following statements is false

Q17: Blossoms Inc., a local florist, is considering

Q18: If the net present value of an

Q20: Newman Auto Repair is considering the purchase

Q21: The NPV method assumes that cash flows

Q22: NPV calculations generally require which of the

Q23: The IRR method assumes that cash inflows

Q24: If a project has an internal rate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents