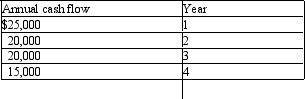

Palmetto Products is considering the purchase of a new industrial machine. The estimated cost of the machine is $50,000. The machine is expected to generate annual cash inflows for the next four years as follows:  The machine is not expected to have a residual value at the end of its useful life. If Palmetto uses a discount rate of 16%, what is the expected net present value of the machine? (ignore taxes)

The machine is not expected to have a residual value at the end of its useful life. If Palmetto uses a discount rate of 16%, what is the expected net present value of the machine? (ignore taxes)

A) $12,800

B) $18,969

C) $(5,816)

D) $7,515

Correct Answer:

Verified

Q27: Finch Corporation purchased an asset costing $12,000.

Q28: C & K Inc. purchased a delivery

Q29: The IRR method assumes that cash inflows

Q30: Bluebird Inc. requires all capital investments to

Q31: Oakwood Inc. requires all capital investments to

Q33: The NPV method assumes that cash inflows

Q34: If a project has an internal rate

Q35: Trenton Inc. is considering an equipment purchase

Q36: Butner Inc. requires all capital investments to

Q37: Grant Inc. would like to replace an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents