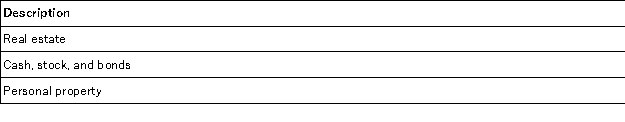

Chloe's gross estate consists of the following property valued at the date of death:

Chloe's real estate is encumbered by a mortgage of $450,000, and Chloe's executor paid her funeral costs of $6,000 and charged fees for $24,000. Which of the following is a true statement?

A) Chloe's adjusted gross estate is at least $7,020,000.

B) Chloe's taxable estate is at least $7,020,000.

C) Chloe's taxable estate is $7,050,000.

D) Chloe's estate will calculate the tentative estate tax on $7.5 million.

E) None of these is true.

Correct Answer:

Verified

Q85: Madison was married at the time of

Q85: At her death Serena owned real estate

Q86: The executor of Isabella's estate incurred administration

Q88: Tracey is unmarried and owns $7 million

Q90: Adjusted taxable gifts are added to the

Q92: Andrea transferred $500,000 of stock to a

Q93: At her death Emily owned real estate

Q94: Which of the following is a true

Q95: This year Alex's friend, Kimberly, was disabled.

Q100: A unified credit is subtracted in calculating

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents