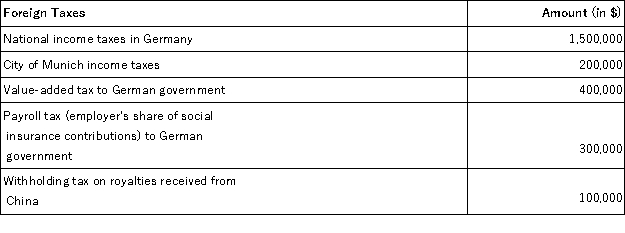

Rainier Corporation, a U.S. corporation, manufactures and sells quidgets in the United States and Europe. Rainier conducts its operations in Europe through a German GmbH, which the company elects to treat as a branch for U.S. tax purposes. Rainier also licenses the rights to manufacture quidgets to an unrelated company in China. During the current year, Rainier paid the following foreign taxes, translated into U.S. dollars at the appropriate exchange rate:

What amount of creditable foreign taxes does Rainier incur?

Correct Answer:

Verified

Explanation: The cr...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q67: Which of the following tax or non-tax

Q68: What form is used by a U.S.

Q74: Boomerang Corporation, a New Zealand corporation, is

Q79: Before subpart F applies, a foreign corporation

Q79: Nicole is a citizen and resident of

Q88: Cheyenne Corporation is a U.S.corporation engaged in

Q92: Spartan Corporation, a U.S. company, manufactures widgets

Q94: Kiwi Corporation is a 100 percent owned

Q98: Jimmy Johnson, a U.S. citizen, is employed

Q105: Portsmouth Corporation, a British corporation, is a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents