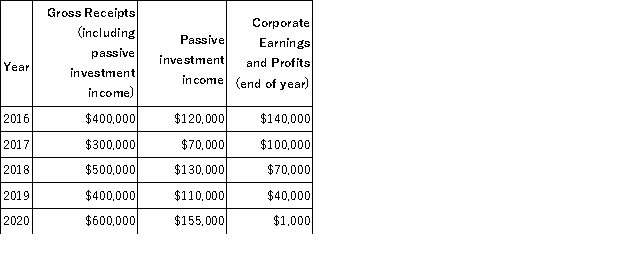

Neal Corporation was initially formed as a C corporation with a calendar year end. Neal elected S corporation status, effective January 1, 2016. On December 31, 2015, Neal Corp. reported earnings and profits of $150,000. Beginning in 2016, Neal Corp. reported the following information. Does Neal Corp.'s S election terminate due to excess net passive income? If so, what is the effective date of the termination?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Which of the following statements is correct?

A)

Q87: Assume that at the end of 2016,

Q100: Which of the following statements is correct

Q101: ABC was formed as a calendar-year S

Q104: ABC was formed as a calendar-year S

Q107: Jackson is the sole owner of JJJ

Q109: CB Corporation was formed as a calendar-year

Q112: Suppose SPA Corp. was formed by Sara

Q113: Maria, a resident of Mexico City, Mexico,

Q113: Jackson is the sole owner of JJJ

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents