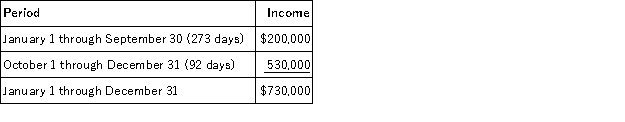

CB Corporation was formed as a calendar-year S corporation. Casey is a 60% shareholder and Bryant is a 40% shareholder. On September 30, 2016, Bryant sold his CB shares to Don. CB reported business income for 2016 as follows (assume that there are 365 days in the year):

How much 2016 income is allocated to each shareholder if CB uses its normal accounting rules to allocate income to the specific periods in which it was actually earned?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Which of the following statements is correct?

A)

Q101: ABC Corp. elected to be taxed as

Q104: ABC was formed as a calendar-year S

Q105: Neal Corporation was initially formed as a

Q107: Jackson is the sole owner of JJJ

Q107: Maria resides in San Antonio, Texas. She

Q110: XYZ was formed as a calendar-year S

Q112: Suppose SPA Corp. was formed by Sara

Q113: Jackson is the sole owner of JJJ

Q113: XYZ Corporation (an S corporation) is owned

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents