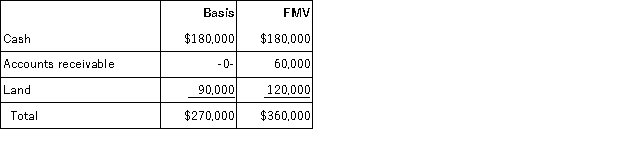

The SSC Partnership balance sheet includes the following assets on December 31 of the current year:

Susan, a 1/3 partner, has an adjusted basis of $90,000 for her partnership interest. If Susan sells her entire partnership interest to Emma for $100,000 cash, what is the amount and character of Susan's gain or loss from the sale?

A) $10,000 capital gain

B) $10,000 ordinary income

C) $20,000 ordinary income; $10,000 capital gain

D) $10,000 capital loss; $20,000 ordinary income

Correct Answer:

Verified

Q21: Under which of the following circumstances will

Q24: Under which of the following circumstances will

Q26: Unrealized receivables include accounts receivable for which

Q27: Which of the following statements regarding the

Q27: Daniel acquires a 30% interest in the

Q29: Which of the following assets would not

Q32: Inventory is substantially appreciated if the fair

Q32: A disproportionate distribution is a distribution in

Q32: The SSC Partnership balance sheet includes the

Q37: Martha is a 40% partner in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents