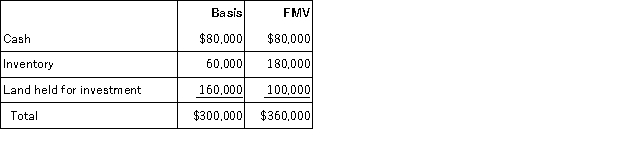

Shauna is a 50% partner in the SH Partnership. Shauna sells one-half of her interest to Kara for $60,000 cash. Just before the sale, Shauna's basis in her entire partnership interest is $150,000 including her $60,000 share of the partnership liabilities. SH's assets on the sale date are as follows:

What is the amount and character of Shauna's gain or loss on the sale?

A) $30,000 ordinary income, $15,000 capital loss.

B) $45,000 capital gain.

C) $15,000 capital loss.

D) $15,000 ordinary income and $30,000 capital gain.

Correct Answer:

Verified

Q21: Under which of the following circumstances will

Q29: Which of the following assets would not

Q33: A partner recognizes gain when he receives

Q34: Jackson is a 30% partner in the

Q34: A §754 election is made by a

Q36: At the end of last year, Cynthia,

Q40: The SSC Partnership balance sheet includes the

Q42: Which of the following is true concerning

Q49: Daniela is a 25% partner in the

Q59: Riley is a 50% partner in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents