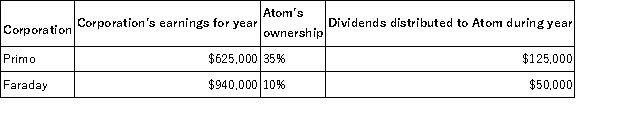

Atom Ventures Inc. (AV) owns stock in the Primo and Faraday corporations. The following summarizes information relating to AV's investment in Primo and Faraday as follows:

Assuming that AV follows the general rules for reporting its income from these investments, what is the amount of AV's book-tax difference associated with the investment in these corporations (disregarding the dividends received deduction)? Is it favorable or unfavorable? Is it permanent or temporary?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: XPO Corporation has a minimum tax credit

Q104: Which of the following statements is false

Q107: In 2016, AutoUSA Inc. received $4,600,000 of

Q111: For book purposes, RadioAircast Inc. reported $15,000

Q112: Which of the following is not an

Q113: Assume a corporation is not required to

Q117: Rapidpro Inc. had more than $1,000,000 of

Q126: Netgate Corporation's gross regular tax liability for

Q129: AR Systems Inc.(AR)had $120,000 of tax liability

Q137: AB Inc.received a dividend from CD Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents