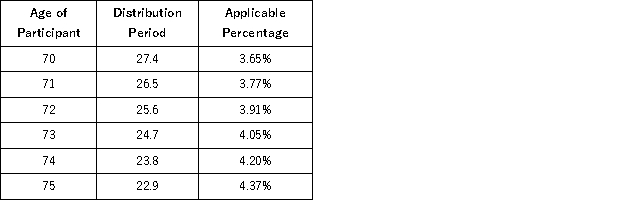

Sean (age 74 at end of 2016) retired five years ago. The balance in his 401(k) account on December 31, 2015 was $1,700,000 and the balance in his account on December 31, 2016 was $1,750,000. In 2016, Sean received a distribution of $50,000 from his 401(k) account. Assuming Sean's marginal tax rate is 25 percent, what amount of the $50,000 distribution will Sean have left after paying income tax on the distribution and paying any minimum distribution penalties (use the IRS table below in determining the minimum distribution penalty, if any).

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q79: Which of the following statements regarding Roth

Q81: Amy files as a head of household.

Q83: Kathy is 48 years of age and

Q86: What is the maximum saver's credit available

Q89: Joan recently started her career with PDEK

Q89: Kathy is 48 years of age and

Q90: Kim (50 years of age) is considering

Q94: Georgeanne has been employed by SEC Corp.

Q98: Which of the following is true concerning

Q106: On March 30, Rodger (age 56)was laid

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents